The good part about Indian stock market is that it is getting more and more institutionalized. Many people are choosing mutual funds and PMS products to channelize their savings instead of putting money directly in stocks. The number of active SIPs has almost doubled in the last 3 years from ~65 lakhs to more than 1.2 crores now, bringing in about INR 4,500 Crores every month to mutual funds. There are many benefits with increasing institutionalization of investments.

Due to institutionalization of investments, there is more maturity in the investment behavior. This would result in lesser volatility and more informed investment choices by market participants. Fund managers, on the basis of their past experiences, have become comparatively more expressive in communicating their assessment of the markets to guide investors regarding their investment decision making. Though, due to their compulsion to not significantly affect the business of mutual funds, they share some vital information which is left for investors and advisers to understand and take corrective steps.

For example, there are few mutual fund schemes in mid & small cap categories which have stopped taking further inflows due to excessive prices in the space. Prominent examples are:

– SBI Small & Mid Cap Fund

– DSPBR Micro Cap Fund

– Mirae Asset Emerging Bluechip Fund

It requires great deal of conviction (of market over-pricing) to stop intake of money as it restricts profitability of mutual funds. However, these fund managers have taken decisions keeping the interest of existing investors in mind, which is highly appreciable. New money in the schemes would have forced the fund managers to invest in already expensive scrips. However, fund managers will not be too vocal about it as it may scare investors. But it is left on investors and their advisers to understand that not just that it is important to stop making new investment to mid & small cap schemes but it is better to exit.

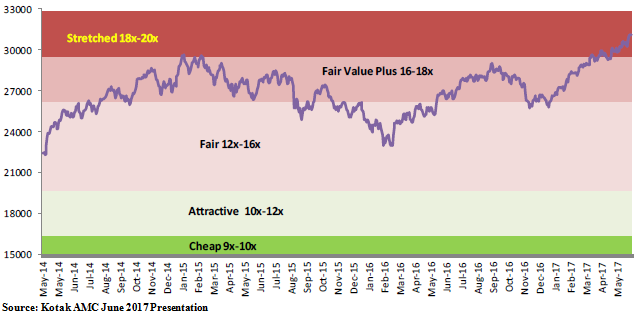

Other examples of mutual funds indicating investors and advisers about market valuation can be seen in presentations of the last few months of some of the AMCs like Kotak & ICICI mutual funds.

Below are the snapshots from the presentations:

Both the AMCs are indicating expensive markets based on their internal models. While Kotak is stressing on SIPs over lumpsum investments, ICICI is pitching SIP and dynamic asset allocation funds. Also, the long term horizon for such investments increases from 5 years to 10 years at such high valuations.

There has been flattish growth of cumulative earnings of Sensex companies over the last 3 years and there is no strong indication for any improvement in this financial year (especially with lingering effects of demonetization and short term disruption due to GST implementation). Many investors do understand that valuations are high but they get carried away by strong liquidity flow. Over the past few months, any sell-offs by FIIs have been strongly negated by DII flows. The problem of TINA (There Is No Alternative – declining real estate, low FD rates and sluggish gold returns) has resulted in massive flow of funds in equity and debt funds. But how long this would continue is highly uncertain.

Many investors have become complacent with respect to their existing investments. In our view, taking this liquidity flow for granted would be a mistake. Many new time investors, lured by past returns and not much sensitization about investments in equity markets may start withdrawing with any sharp drop. That correction can be triggered by any domestic or global event.

Thus it is vital to stick to tactical asset allocation depending upon the risk profile and not get over-allocated to equity markets. Being driven by the principals of value investing, we will continue to wait for fair valuation (10-15% correction) to deploy fresh funds in equity schemes while exiting mid & small cap space and reducing overall equity exposure with any further rise in the markets. For debt markets, we would continue to deploy funds in lower duration portfolios to minimize the impact of volatility in interest rates in the backdrop of GST implementation.

Assuring financial peacefulness…

Please Note: This is a financial education initiative by Truemind Capital to promote investment literacy among the masses. Truemind Capital is a SEBI registered investment adviser and operates www.truemindcapital.com for investments in mutual funds. You agree to accept and abide by terms & conditions if you take any decision based on the content in the above article.

You can write to us at connect@truemindcapital.com or call us on 9999505324.