Indians are very good at buying stuff which can offer best value for money. We would buy clothes when there is a discount sale. Many rush to buy groceries in Big Bazaar on Wednesday. We are happy to enjoy happy hours in bars and prefer visiting restaurants which offer great experience compared to prices paid. Majority Indians buy cars made by Maruti as they think it offers best value for money. We seek for the best possible discount on everything we buy. Or do we?

Well if data is to be believed, we Indians fail miserably when it comes to investing in Equity markets. Approximately 75%-80% of the inflows in equity market comes when the markets are expensive i.e. the prices are much higher compared to underlying values. The blame for this attitude towards equity is ignorance of the concept of Price vs. Value. Ignorance also lies in an assumption that past returns are indicator of future performance. This lack of understanding results in severe disappointment when expectations are not met as they were set on flawed assumptions.

Let us understand the difference between price and value.

Stock prices are the daily ticker on the screen which is very easy to know. Difficult part is to know the real value of the stock which is also known as intrinsic value. There are various methods used by analyst to determine intrinsic value of the stock like discounting cash flows, Gordon growth model, EV/EBIDTA, relative valuation etc. These methods involve lot of analysis with respect to understanding businesses, reasonable projections and applying appropriate discount rates.

For common people it is not easy to find intrinsic value and thus should be best left to investment experts. However, one of the most popular and time tested valuation ratio is Price per Earning (PE) multiple which can be accessed by a common investor to get an idea of market valuation. Although historical average PE ratio is not a perfect indicator as so many elements (like future earnings growth, quality of earnings, interest rates etc) contribute to it and are not static, but could be a good starting point to build a case.

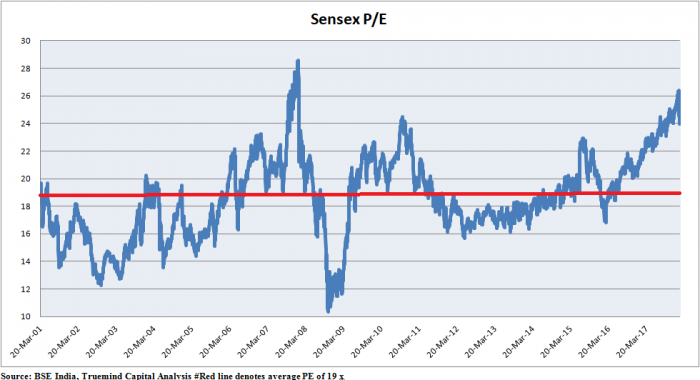

Historical 10-15 years average PE of SENSEX is 19x. One can safely assume that intrinsic value of SENSEX is 19x PE multiple. PE above 19x should be considered as an expensive market i.e. prices are higher than the underlying value. Similarly, PE below 19x should be considered as a cheap market i.e. prices are below intrinsic value. Although many market participants are making a case for permanent higher intrinsic value for PE (also known as re-rating) on the backdrop of low interest rates, they miss out on the fact that low interest rate is an indicator of low earnings growth. Moreover, over the last few years, the quality of earnings has also gone down. Avg. return on equity (ROE) which was at 24%-25% in the period 2004-2007, is now at around 13%-14%, implying lower quality of earnings.

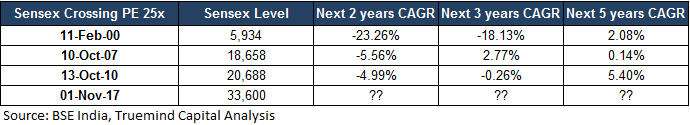

Presently PE ratio of SENSEX is around 24x-25x which is way above fair valuation of 19x implying we are in expensive zone. And true to the historical data, retail investors are frantically putting money seduced by historical returns. However, if 100 years of investment history is any guide, there is cost to pay for investing in prices which are much above the intrinsic value. The cost is poor future returns, losses and disappointment as indicated in the table below.

Warren Buffet said – Price is what you pay, value is what you get. He also quipped that if you are shopping for common stocks; choose them the way you would buy groceries, not the way you would buy perfume. The gist is to not being reckless or adventurous while investing your hard earned money in equity markets. The risk is not in asset classes but in the price at which the investment is done. Investments in prices above intrinsic value will not just increase downside risk but also reduce future returns potential. On the other hand, investment in prices below intrinsic value would not just lower the down side risk (also known as margin of safety) but enhance the upside potential returns.

Keeping these words of wisdom in mind and simple logic of buying low and selling high, one must patiently wait for prices to come at or below intrinsic value. The key is patience. It requires great deal of courage to see others making money and be unaffected by psychological pressures of riding the momentum. This may result in short term underperformance in a bull market but will ensure significant long term out performance.

Strategy for the current markets:

On the back of stretched prices and return of volatility in global stock markets, we at Truemind Capital continue to maintain a cautionary stance on equity investments. The risk reward ratio doesn’t appear favorable for equity asset class and thus one must reduce the equity exposure in overall asset allocation according to his/her risk profile. Any exposure to small & mid cap schemes should be completely avoided since this category is trading at life time high valuations with significant downside risk. A correction of ~15-20% in SENSEX would be a good level for making lump-sum investments.

Assuring financial peacefulness…

Please Note: This is a financial education initiative by Truemind Capital to promote investment literacy among the masses. Truemind Capital is a SEBI registered investment adviser and operates www.truemindcapital.com for investments in mutual funds. You agree to accept and abide by terms & conditions if you take any decision based on the content in the above article.

You can write to us at connect@truemindcapital.com or call us on 9999505324.

7 Comments

Pingback: What Is Causing Market Panic And How To Deal With It? | Investment Blog

Pingback: Market Cycles & Investment Lessons from History | Investment Blog

Pingback: Do you need social proof to invest? | Investment Blog

Pingback: Is Fear of Missing Out playing on your mind? - Investment Blog

Pingback: Timing the Market or Time in the Market - Investment Blog

Pingback: The time has finally come - Investment Blog

Pingback: Market Cycles & Investment Lessons from History – CFA Society India